How I saved to buy a home on small salary

All of us dream of having at least one house by the age of 30. Infact, some of the smart people who invest early by the age of 20 have more than one house by the age of 30.

The point being, it is important to invest early so that you can retire early and rich while money you have earned works for you. You can then quit your 9 to 5 job and work or volunteer towards the cause you believe in. The formula is simple “Save before you Spend”.

Income(100%) = Spend on Needs(50%) + Wants(30%) + 20%(Savings) – by Senator Elizabeth Warren

Disclaimer: I am not a professional financial advisor in stock trading and if you are investing in stocks with huge amount please consult a professional.

Having said that, I have learnt about some no-bullshit tools that help even novice investors like me to invest in small amounts smartly with a small income.

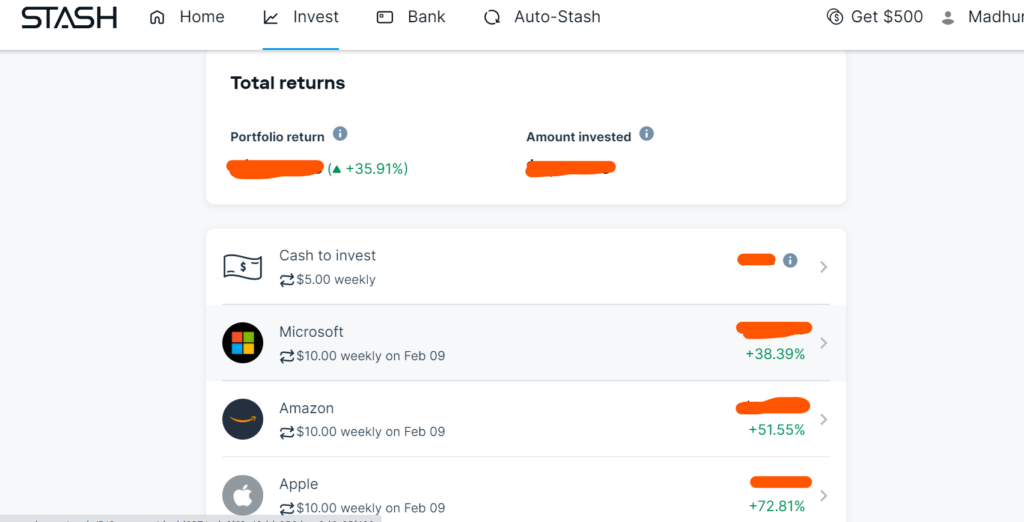

- Stash: Yes, you must have heard about this tool from so many people and it has stood up to its fame. Using Stash app you can buy a fraction of shares of big companies(like Amazon, Google etc.) and also buy indexed funds. It is a beginner-friendly app for traders. You can choose to be conservative and invest in slow but steadily growing stocks(like Home depot, Proctor & Gamble, AT&T etc.) also called Blue Chips that give dividends monthly and set a recurring monthly investment into them. It also provides some aggregated funds like Conservative mix, Match the market etc. which invest into multiple stocks at the same time. It has helped me grow my funds rather than sitting in my bank account idly. You can click on the link here to get $20 bonus stock, when you join and add as little as $5 of cash. Yes, you can start trading with as small amount as $5 and easy to use app to start your investment journey.

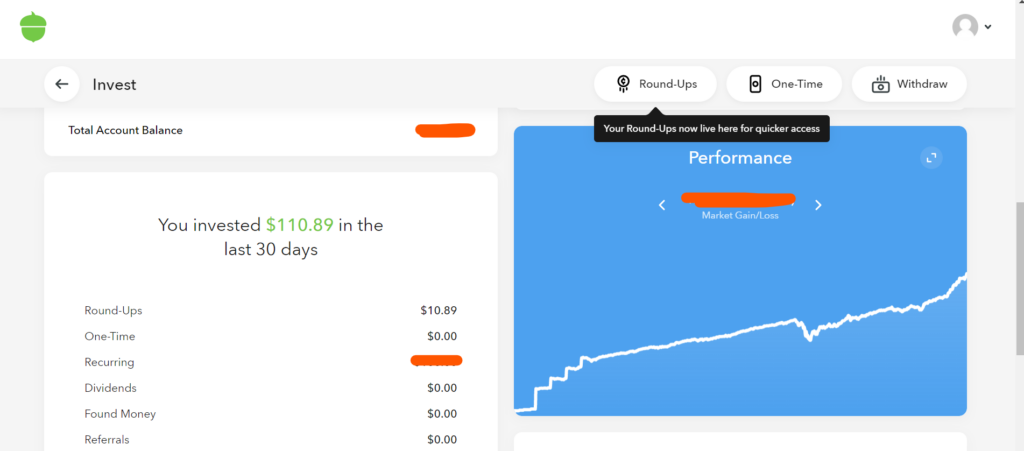

- Acorns: This app uses a really smart way to invest your money. Every time you spend money on something it rounds it up to a dollar and once it is $5 it will invest that amount into your investment portfolio. for ex: if you bought a yoga mat from Amazon for $20.05 then it saves the $0.95 to invest. The spare change keeps adding until it is $5 and then gets invested. All of this is automatized and you don’t have to worry about investing or choosing stocks. All you have to do is link your Credit cards or spending accounts you use to shop and a primary checking account to debit the money from. You can choose a Conservative profile that is risk-free or if you are daredevil you can go for an aggressive one. This app doesn’t have individual stocks like Microsoft, Amazon or any other company for that matter but you actually choose a profile you are interested in – conservative, moderate or aggressive. You can also set a recurring investment into it of $25/week or whatever you can afford and it will keep growing along with roundups. It is like choosing a goal amount and investing towards it. You can click here to join and get $5 bonus when you join with this link.

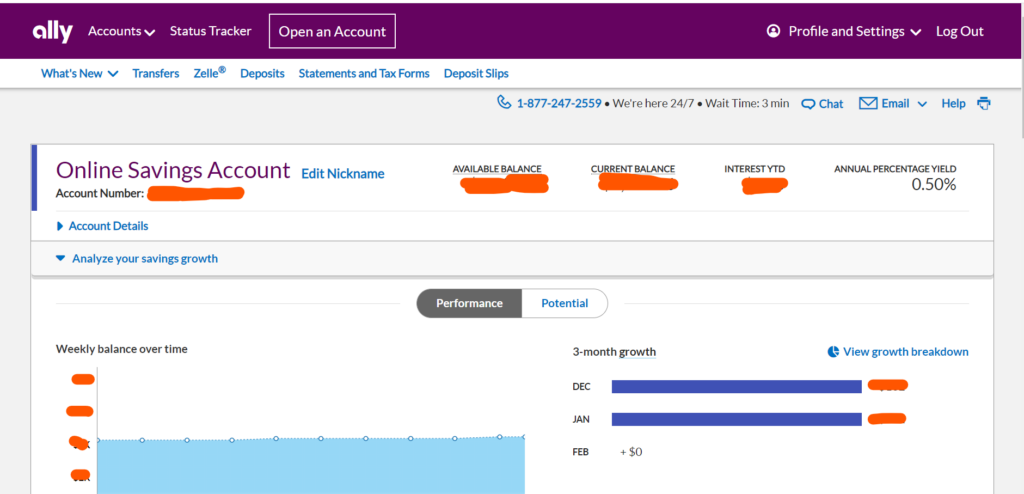

- Savings builder accounts : When money just sits in your traditional bank account it just sits there and looses its value as the value of money decreases due to inflation. The best example is that in 1970, the cost of house used to be around $23000 but now in some areas you don’t get a decent home even for a $1 Million. So your hard earned money through prime years of age will reduce in value as you age. Inorder to avoid it and still have the flexibility to withdraw whenever(6 transactions/month) you can invest in Dividend or interest earning savings account which are FDIC(secured) approved. They give an interest rate which a traditional bank savings account cannot give because they don’t have many or no physical institutions. All of their transactions happen online and provide online support 24×7 and since they can save the money in maintaining a physical banks they provide their clients with more interest. Make sure you deposit in FDIC(Federal Deposit Insured Corporation) secured bank account so your money has security too. I personally use First tech federal credit union(low interest rates on loans too), Ally Bank and CIT bank which give 24×7 support and give competitive interest rates. You can check the latest interest rates here.

- Robinhood: Robinhood is also one of the popular apps used by many people to invest. You must have already known about it, if you are an avid investor. It is an easy to use app. you can maintain your personal investment portfolio here. It offers a varied no. of ways to invest like fractional stocks, optional intra-day trading and direct stocks to buy. I have bought dividend earning stocks coco-cola, Proctor & Gamble, GE etc. from this app. You can build a passive income from this app if you keep investing regularly and see which stocks don’t fluctuate and have consistency

- 401k or Roth IRA: Retirement as we all think will only come at 60 or more because of which we don’t care about it. But the new trend is FIRE(Financial Independence Retire Early) which is to retire early and enjoy doing what we wish to do, travel or give back to the society. Also, there is inflation which will reduce the value of your money over the years. So it is important to save towards the retirement early. If your employer offers a 401k with contribution then take it. You can save upto $19500/year(pre-tax) towards it along with your employers contribution. You can save more towards Roth IRA(you pay tax only when depositing into this account, all the withdrawals will be tax-free afterwards). Even if your employer doesn’t offer it, you can open your own IRA account with Stash or Acorns app easily and contribute with tax benefits.

- Gold bonds/Commodity: Another way to invest your money is to buy assets or commodities that grow in value over the years like Gold, Silver, Real estate(something that is not your primary residence) etc. You can invest in gold either through gold bonds/contracts or buy gold commodity/ornaments, because gold is one of the precious metals and and is a limited resource. Therefore, it has a great potential to grow over time and diversifies your investment portfolio as you have seen even in this pandemic the gold value has not decreased in fact it has sky rocketed.

These are some of the apps and tools I used to invest when I was working for a small salary. If you are know any more apps or better income generating apps, please do comment and let me know. It will help us as well as many other people who are in need for second income. Stay tuned for more such interesting content.